Matthew J. Previte Cpa Pc Things To Know Before You Buy

Matthew J. Previte Cpa Pc for Beginners

Table of ContentsExamine This Report about Matthew J. Previte Cpa PcExcitement About Matthew J. Previte Cpa PcExamine This Report on Matthew J. Previte Cpa PcNot known Details About Matthew J. Previte Cpa Pc Matthew J. Previte Cpa Pc Things To Know Before You Get ThisMatthew J. Previte Cpa Pc - An Overview

Tax obligation legislations and codes, whether at the state or federal level, are as well made complex for the majority of laypeople and they transform too often for lots of tax obligation experts to stay up to date with. Whether you simply require somebody to assist you with your business income tax obligations or you have been billed with tax scams, hire a tax lawyer to aid you out.

The smart Trick of Matthew J. Previte Cpa Pc That Nobody is Discussing

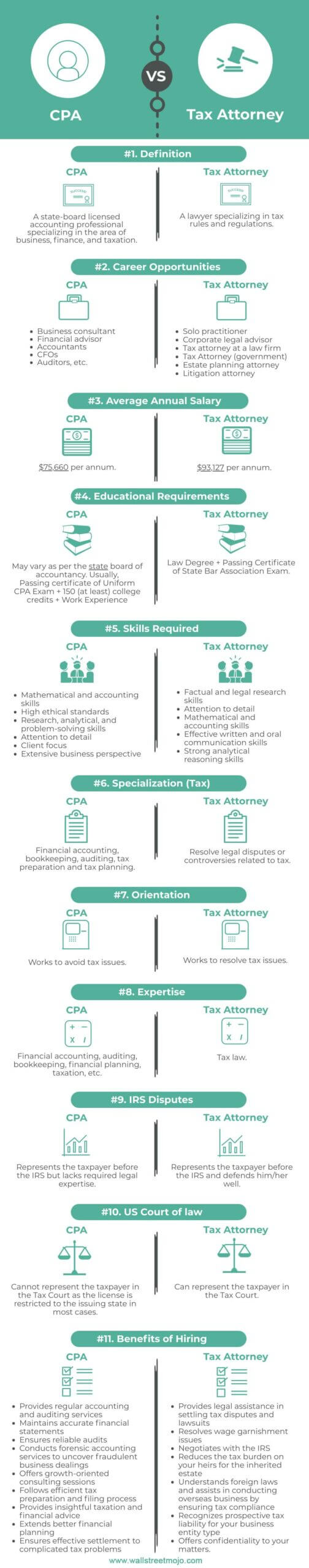

Everybody else not only dislikes taking care of tax obligations, however they can be straight-out worried of the tax agencies, not without factor. There are a few questions that are always on the minds of those that are handling tax troubles, including whether to employ a tax obligation attorney or a CPA, when to work with a tax obligation attorney, and We really hope to assist respond to those inquiries right here, so you know what to do if you discover on your own in a "taxing" scenario.

A lawyer can stand for clients prior to the IRS for audits, collections and charms however so can a CERTIFIED PUBLIC ACCOUNTANT. The big difference here and one you require to bear in mind is that a tax obligation legal representative can offer attorney-client benefit, suggesting your tax obligation attorney is exempt from being urged to indicate against you in a law court.

Not known Incorrect Statements About Matthew J. Previte Cpa Pc

Or else, a CPA can affirm versus you even while working for you. Tax obligation lawyers are extra acquainted with the different tax negotiation programs than a lot of CPAs and know how to pick the most effective program for your situation and how to obtain you gotten that program. If you are having a trouble with the IRS or simply concerns and issues, you need to employ a tax obligation lawyer.

Tax obligation Court Are under investigation for tax fraud or tax obligation evasion Are under criminal examination by the IRS Another vital time to work with a tax obligation attorney is when you obtain an audit notification from the IRS - IRS Levies in Framingham, Massachusetts. https://disqus.com/by/matthewjprevite/about/. A lawyer can communicate with the IRS in your place, be present throughout audits, help discuss settlements, and keep you from paying too much as a result of the audit

Part of a tax lawyer's obligation is to stay up to date with it, so you are shielded. Your finest source is word of mouth. Ask around for a seasoned tax obligation attorney and check the net for client/customer testimonials. When you interview your option, ask for added references, especially from clients that had the exact same find more information concern as your own.

See This Report about Matthew J. Previte Cpa Pc

The tax attorney you have in mind has every one of the right qualifications and testimonies. All of your concerns have been responded to. tax lawyer in Framingham, Massachusetts. Should you employ this tax obligation lawyer? If you can manage the costs, can consent to the kind of potential service used, and believe in the tax attorney's capability to assist you, after that yes.

The decision to employ an internal revenue service attorney is one that ought to not be ignored. Lawyers can be exceptionally cost-prohibitive and make complex issues needlessly when they can be dealt with fairly quickly. In basic, I am a big proponent of self-help legal solutions, particularly provided the variety of informational product that can be located online (consisting of much of what I have actually published on tax).

What Does Matthew J. Previte Cpa Pc Do?

Below is a quick list of the matters that I believe that an Internal revenue service attorney should be employed for. Bad guy fees and criminal investigations can damage lives and carry extremely significant consequences.

Offender charges can likewise lug additional civil charges (well past what is typical for civil tax issues). These are simply some instances of the damage that also simply a criminal charge can bring (whether or not an effective sentence is eventually gotten). My factor is that when anything possibly criminal occurs, also if you are simply a prospective witness to the issue, you need a skilled IRS attorney to represent your rate of interests versus the prosecuting agency.

Some may stop short of absolutely nothing to get a sentence. This is one circumstances where you always need an IRS attorney watching your back. There are lots of components of an internal revenue service lawyer's task that are seemingly regular. Many collection matters are handled in about the exact same way (despite the fact that each taxpayer's situations and goals are various).

What Does Matthew J. Previte Cpa Pc Do?

Where we gain our red stripes however is on technological tax obligation matters, which placed our full ability to the examination. What is a technical tax obligation problem? That is a hard concern to respond to, however the most effective way I would certainly define it are matters that require the expert judgment of an internal revenue service lawyer to settle effectively.

Anything that has this "truth reliance" as I would certainly call it, you are mosting likely to intend to bring in a lawyer to seek advice from with - IRS Seizures in Framingham, Massachusetts. Also if you do not preserve the services of that lawyer, an experienced viewpoint when handling technological tax obligation matters can go a lengthy way towards comprehending problems and solving them in a suitable way